SIP Calculator - Investment Growth Made Clear

Financial Tools

SIP Calculator is your comprehensive solution for mastering systematic investment planning with professional-grade investment analysis tools and wealth creation optimization. I help you transform complex investment mathematics into simple, understandable projections for achieving your financial goals through disciplined monthly investing.

We know how challenging it can be to visualize long-term investment outcomes, plan for retirement, or understand the power of compounding manually. Maybe you're planning for children's education, building retirement wealth, or comparing different investment scenarios. SIP Calculator eliminates this complexity by providing precise calculations with year-by-year breakdowns and professional Excel integration.

Key Benefits

How to Use

Using SIP Calculator is straightforward and comprehensive:

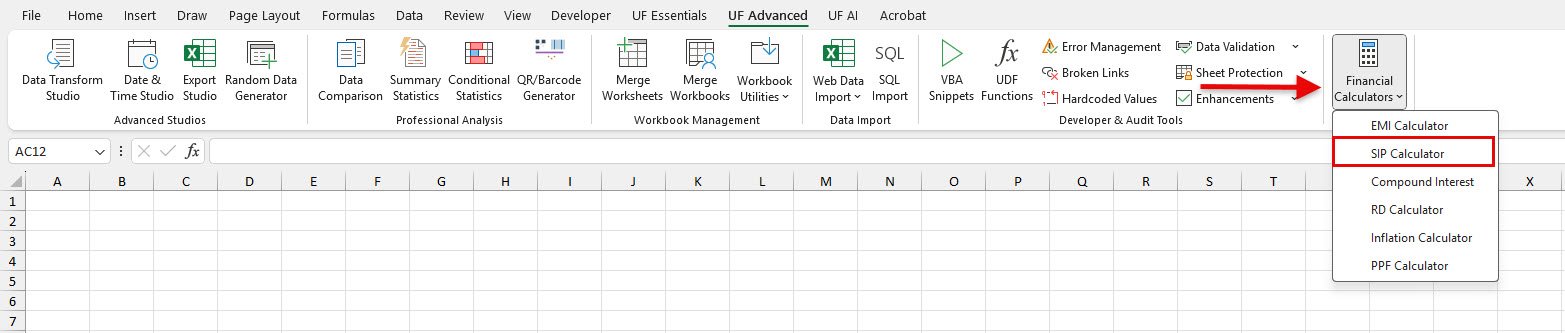

- Go to UF Advanced tab → Financial Tools group

- Click Financial Calculators → SIP Calculator

- Enter Investment Details: Monthly SIP amount, expected return rate, and investment period in years

- View Instant Results: Total invested amount, wealth gained, and maturity value

- Analyze Growth: Understand progressive wealth building through compounding

- Add to Excel: Insert complete analysis with year-by-year breakdown

Examples

Example 1: Retirement Planning Strategy

Scenario: You're 30 years old and want to build a retirement corpus by age 60.

Steps:

- Open SIP Calculator from UF Advanced → Financial Tools

- Enter Monthly SIP: 15000

- Set Expected Return: 12 (equity mutual funds average)

- Set Investment Period: 30 years

- Results:

- Total Invested: ₹54 lakhs

- Maturity Value: ₹5.29 crores

- Wealth Gained: ₹4.75 crores

- Add to Excel for detailed retirement planning analysis

Example 2: Child's Education Fund Planning

Scenario: You want to accumulate ₹50 lakhs for your child's higher education in 15 years.

Steps:

- Launch SIP Calculator

- Try different SIP amounts to reach target

- Enter Monthly SIP: 8000

- Set Expected Return: 10

- Set Investment Period: 15 years

- Result: Maturity Value ≈ ₹41 lakhs (increase SIP to ₹10,000 for ₹50+ lakhs)

- Adjust SIP amount to meet exact education funding goal

Example 3: Wealth Creation Comparison

Scenario: Compare different return scenarios for the same SIP to understand risk-return impact.

Steps:

- Enter Monthly SIP: 10000

- Set Investment Period: 20 years

- Compare different return expectations:

- 8% return: Maturity ₹59 lakhs

- 10% return: Maturity ₹76 lakhs

- 12% return: Maturity ₹99 lakhs

- Understand impact of return rates on wealth creation

- Choose appropriate asset allocation based on risk tolerance

- Investment Strategy: Start early for maximum compounding benefit and use conservative return estimates (10-12% for equity)

- Discipline: Maintain consistent SIP regardless of market conditions and automate investments for consistency

- Planning: Match SIP tenure with financial goals and increase SIP amount with salary increments

- Return Expectations: Use realistic rates and understand market cycles with long-term focus

- Review Process: Annual review and adjustment of SIP amounts based on goal progress

- Patience: Allow investments sufficient time to compound effectively and avoid stopping during downturns

Common Use Cases

Long-term Wealth Creation

- Build retirement corpus through systematic equity SIP investments over 20-30 years

- Create wealth for financial independence and early retirement planning

- Build generational wealth through long-term systematic investment discipline

- Plan for major life goals like children's marriage and higher education expenses

Goal-Based Investment Planning

- Save for children's education with timeline-specific SIP planning and cost escalation

- Build house down payment corpus through systematic investment approach

- Create travel and lifestyle funding through dedicated SIP investments

- Plan for major purchases like vehicles and luxury items with systematic savings

Frequently Asked Questions

For equity mutual funds, expect 10-12% long-term returns. For balanced funds, 8-10%. For debt funds, 6-8%. Use conservative estimates for planning and understand that returns vary year to year.

Generally, invest 10-20% of your monthly income in SIPs. Start with smaller amounts and increase gradually. Prioritize based on financial goals and ensure you maintain emergency funds.

Yes, continuing SIP during downturns is beneficial as you buy more units at lower prices (rupee cost averaging). Market volatility is normal, and long-term investing smooths out short-term fluctuations.

Yes, most mutual funds allow SIP amount changes. You can increase (step-up SIP) or decrease amounts based on financial situation. Some funds also offer flexible SIP options.

SIP reduces timing risk through rupee cost averaging and builds investment discipline. Lump sum can be better if markets are low, but SIP is generally safer for regular investors without market timing skills.

Related Documentation

EMI Calculator - Loan Planning Made Simple

Calculate EMI, total interest, and amortization schedules for home loans, car lo...

Read DocumentationCompound Interest - Investment Growth Mastery

Master compound interest calculations with comprehensive growth analysis tools....

Read DocumentationRD Calculator - Recurring Deposit Planning Simplified

Calculate RD maturity, interest earned, and systematic savings goals. Plan recur...

Read Documentation