RD Calculator - Recurring Deposit Planning Simplified

Financial Tools

RD Calculator is your comprehensive solution for mastering recurring deposit planning with professional-grade analysis tools and systematic savings optimization. I help you transform recurring deposit mathematics into clear, actionable savings insights for achieving your financial goals through disciplined monthly investments.

We understand how difficult it can be to plan systematic savings, compare different RD schemes, or calculate long-term maturity amounts manually. Maybe you're building an emergency fund, saving for specific goals, or comparing RD options with other investment alternatives. RD Calculator eliminates this complexity by providing precise calculations with detailed breakdowns and professional Excel integration.

Key Benefits

How to Use

Using RD Calculator is straightforward and powerful:

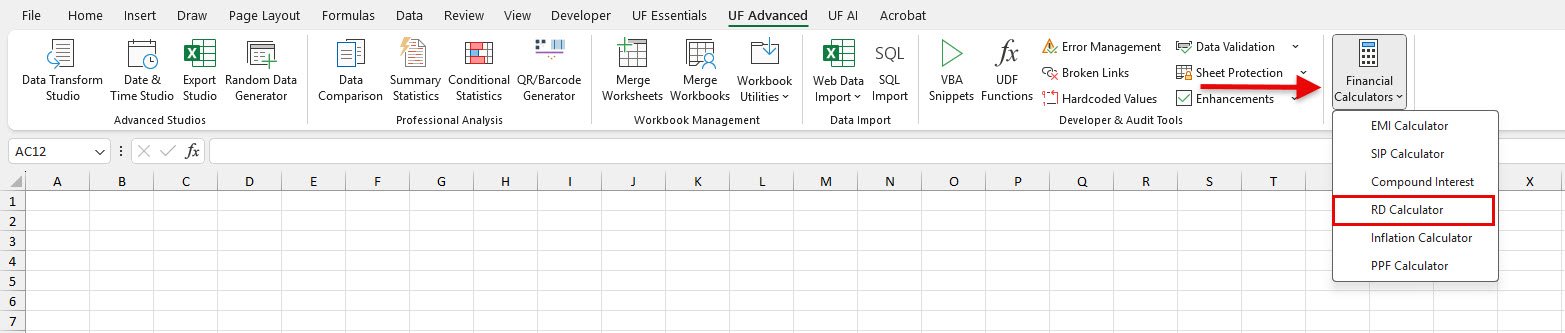

- Go to UF Advanced tab → Financial Tools group

- Click Financial Calculators → RD Calculator

- Enter RD Details: Monthly deposit amount, interest rate, and tenure in years

- View Instant Results: Total deposits, interest earned, and maturity amount

- Analyze Growth: See how systematic savings grow through compound interest

- Add to Excel: Insert complete analysis with summary reports

Examples

Example 1: Emergency Fund Building

Scenario: You want to build an emergency fund of ₹5 lakhs through RD in 5 years.

Steps:

- Open RD Calculator from UF Advanced → Financial Tools

- Target: ₹5 lakhs in 5 years

- Try different monthly amounts to reach target

- Enter Monthly Deposit: 7000

- Set Interest Rate: 6.5 (current RD rates)

- Set Tenure: 5 years

- Result: Maturity ≈ ₹4.6 lakhs (increase to ₹8,000 for ₹5+ lakhs target)

- Adjust deposit amount to meet exact goal

Example 2: Child's Education Fund

Scenario: You want to save for your child's higher education through systematic RD planning.

Steps:

- Launch RD Calculator

- Enter Monthly Deposit: 5000

- Set Interest Rate: 6.8

- Set Tenure: 10 years

- Results:

- Total Deposits: ₹6 lakhs

- Maturity Amount: ≈ ₹8.2 lakhs

- Interest Earned: ≈ ₹2.2 lakhs

- Add to Excel for detailed education funding analysis

- Planning Strategy: Start early for maximum benefit and set achievable monthly deposit amounts

- Deposit Management: Automate deposits and ensure sufficient balance to avoid penalties

- Rate Optimization: Compare RD rates across banks and look for special category benefits

- Goal Alignment: Match RD tenure with financial goals and plan for reinvestment at maturity

- Consistency: Maintain regular monthly deposit discipline and avoid defaults

- Maturity Planning: Plan for reinvestment or utilization at maturity based on financial needs

Common Use Cases

Goal-Based Systematic Savings

- Build emergency funds through disciplined monthly RD investments

- Save for specific short-term goals like vacations, gadgets, or home improvements

- Plan for medium-term goals like house down payment or vehicle purchase

- Create systematic savings for children's education and marriage expenses

Financial Discipline and Habit Building

- Develop regular saving habits with RD commitment and automated deposits

- Build systematic investment discipline for long-term wealth creation

- Create forced savings mechanism to avoid spending temptations

- Establish financial discipline foundation for future investment strategies

Frequently Asked Questions

RD interest is calculated quarterly on the minimum balance and credited annually. Each monthly deposit earns interest for different periods, with earlier deposits earning more interest than later ones.

Missing installments usually attracts penalty charges and may affect the maturity amount. Some banks allow a grace period, but consistent defaults can lead to account closure. Maintain sufficient balance for automated deposits.

RDs offer guaranteed returns with capital protection but lower potential returns. SIPs offer higher potential returns but with market risk. Choose based on your risk tolerance and financial goals.

Most RDs allow premature withdrawal with penalty charges and reduced interest rates. Some banks offer loan facilities against RD deposits. Check specific bank terms before opening RD.

Yes, RD interest is taxable as per your income tax slab. TDS is deducted if annual interest exceeds ₹40,000 (₹50,000 for senior citizens). Factor tax implications in return calculations.

Related Documentation

EMI Calculator - Loan Planning Made Simple

Calculate EMI, total interest, and amortization schedules for home loans, car lo...

Read DocumentationSIP Calculator - Investment Growth Made Clear

Calculate SIP maturity, wealth gained, and investment growth with comprehensive...

Read DocumentationCompound Interest - Investment Growth Mastery

Master compound interest calculations with comprehensive growth analysis tools....

Read Documentation