PPF Calculator - Tax-Saving Investment Mastery

Financial Tools

PPF Calculator is your comprehensive solution for mastering Public Provident Fund planning with professional-grade analysis tools and tax benefit optimization. I help you transform complex PPF mathematics into clear, actionable investment insights for maximizing this powerful tax-saving investment opportunity.

We know how challenging it can be to understand PPF's unique benefits, calculate long-term returns, or plan extension strategies manually. Maybe you're trying to maximize tax savings under Section 80C, planning long-term wealth creation, or understanding PPF's EEE tax status. PPF Calculator eliminates this complexity by providing precise calculations with tax benefit analysis and professional Excel integration.

Key Benefits

How to Use

Using PPF Calculator is straightforward and comprehensive:

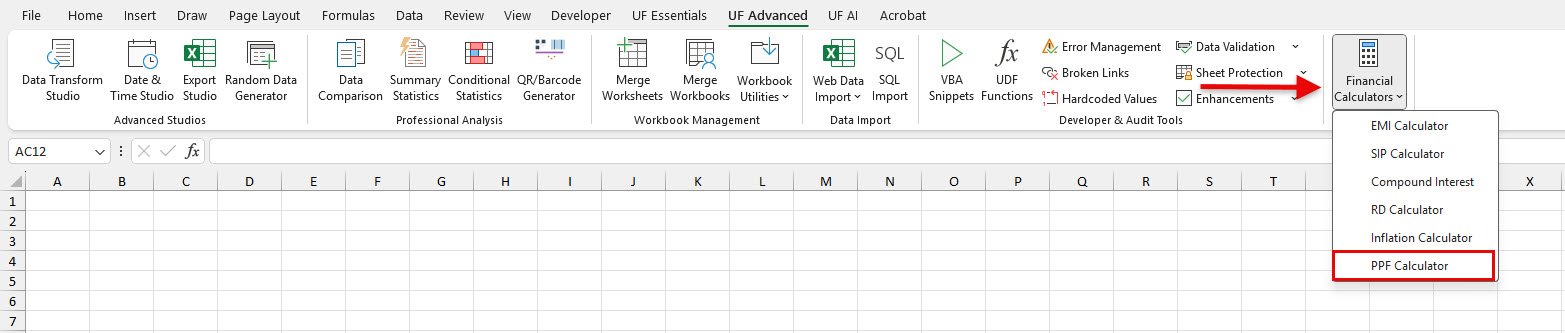

- Go to UF Advanced tab → Financial Tools group

- Click Financial Calculators → PPF Calculator

- Enter PPF Details: Annual investment (₹500 to ₹1.5 lakhs), current PPF interest rate, investment period

- View Results: Maturity amount, interest earned, tax savings, and total investment

- Analyze Benefits: Understand complete tax advantages and wealth creation potential

- Add to Excel: Insert complete analysis with year-wise breakdown

Examples

Example 1: Maximum PPF Investment Strategy

Scenario: You want to maximize PPF benefits by investing ₹1.5 lakhs annually for complete tax optimization.

Steps:

- Open PPF Calculator from UF Advanced → Financial Tools

- Enter Annual Investment: 150000

- Set Interest Rate: 7.1 (current PPF rate)

- Set Period: 15 years

- Results:

- Total Investment: ₹22.5 lakhs

- Maturity Amount: ≈ ₹40.68 lakhs

- Interest Earned: ≈ ₹18.18 lakhs

- Annual Tax Saving: ₹46,800 (at 30% tax bracket)

- Add to Excel for detailed year-wise analysis

Example 2: Child's PPF Planning

Scenario: You start PPF for your newborn child with ₹1 lakh annually for long-term financial security.

Steps:

- Access PPF Calculator

- Enter Annual Investment: 100000

- Set Interest Rate: 7.1

- Set Period: 15 years

- Result: Child gets ≈ ₹27.12 lakhs tax-free at age 15

- Extension planning: Can extend for higher education funding

- Create comprehensive education funding strategy

- Investment Strategy: Maximize contribution to ₹1.5 lakhs annually if possible and deposit before 5th of month for maximum interest

- Tax Planning: Use PPF as primary 80C investment and consider higher tax bracket benefits

- Family Optimization: Open PPF accounts for all eligible family members for maximum tax benefits

- Extension Strategy: Evaluate extension vs alternative investments at maturity and plan post-PPF investment strategy

- Timing Optimization: Deposit early in financial year for maximum benefit and maintain consistent annual contributions

- Long-term Perspective: View PPF as 15+ year investment with potential extensions for continued benefits

Common Use Cases

Tax Optimization and Savings

- Maximize Section 80C deductions with PPF as primary tax-saving investment

- Build tax-free wealth creation strategy for retirement and long-term goals

- Optimize tax planning across family members with multiple PPF accounts

- Balance PPF with other tax-saving investments for comprehensive tax strategy

Family Financial Security

- Start PPF for children's financial security and education funding

- Plan for children's marriage expenses with long-term PPF strategy

- Create family wealth building strategy with multiple PPF accounts

- Build emergency corpus with PPF loan facility from 3rd year onwards

Frequently Asked Questions

PPF allows minimum ₹500 and maximum ₹1.5 lakhs annual investment. Higher investments provide better tax savings and wealth creation, but even smaller amounts benefit from tax-free compounding.

PPF offers unique EEE tax status (investment, growth, and maturity all tax-free) with government guarantee. While returns may be lower than equity, the tax benefits and safety make it attractive for conservative investors.

You can extend for 5-year blocks with or without contributions, withdraw the entire amount, or make partial withdrawals. Extension allows continued tax-free growth.

No, you can have only one PPF account in your name. However, you can open separate accounts for spouse and minor children, effectively multiplying family PPF benefits.

Related Documentation

EMI Calculator - Loan Planning Made Simple

Calculate EMI, total interest, and amortization schedules for home loans, car lo...

Read DocumentationSIP Calculator - Investment Growth Made Clear

Calculate SIP maturity, wealth gained, and investment growth with comprehensive...

Read DocumentationCompound Interest - Investment Growth Mastery

Master compound interest calculations with comprehensive growth analysis tools....

Read Documentation