Automate GST Reconciliation in Minutes

Smart Excel add-in that matches 10,000+ invoices in seconds. Save 80% time on GSTR-2B and GSTR-1 reconciliation.

Complete GST Reconciliation Suite

Everything you need for accurate GST compliance

Settings & Configuration

Easy to configure and customize

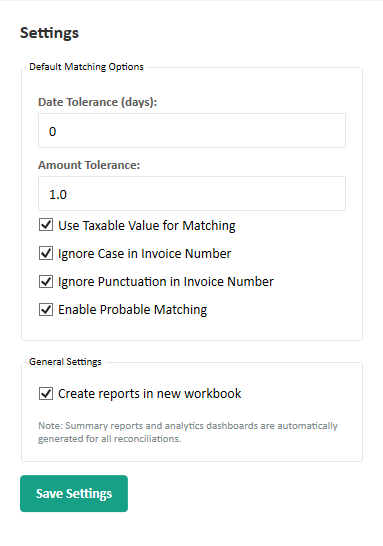

Customize default reconciliation behavior through the Settings panel:

Default Matching Options:

- Date Tolerance (days): Set acceptable date variance for probable matching (default: configurable)

- Amount Tolerance: Configure acceptable amount differences for rounding variations

- Use Taxable Value for Matching: Choose to match on taxable value instead of total value

- Ignore Case in Invoice Number: Treat "INV001" and "inv001" as the same invoice

- Ignore Punctuation in Invoice Number: Treat "INV-001" and "INV001" as the same

- Enable Probable Matching: Toggle fuzzy matching with tolerance-based matching

General Settings:

- Create reports in new workbook: Export results to a new workbook instead of adding to current workbook

Note: Summary reports and analytics dashboards are automatically generated for all reconciliations.

All settings are saved automatically and applied as defaults for new reconciliations. You can override these settings during the reconciliation wizard for specific needs.

How It Works

Simple 6-step process to complete reconciliation

Install Add-in

Download XLL file and load into Excel 2016+

Import Data

Load GSTR and Register into separate sheets

Select Type

Choose reconciliation type from ribbon

Map Columns

Auto-suggested field mappings

Configure Rules

Set tolerances and options

Get Results

Instant detailed reports

Why Choose UnleashedGST

Built for accuracy, speed, and ease of use

Smart Matching

Exact and probable matching with configurable tolerances for dates and amounts

Lightning Fast

Process 10,000 invoices in 5-15 seconds with optimized performance

Analytics Dashboard

Visual charts and KPIs with pivot tables for instant insights

Simple Pricing

One-time payment, lifetime access

Lifetime License

One-time payment • No recurring fees

- Unlimited reconciliations

- Process unlimited invoices

- GSTR-2B/2A vs Purchase

- GSTR-1 vs Sales

- Credit & Debit Notes

- Smart auto-mapping

- Professional reports

- Analytics dashboard

- Email support

- Life time updates

Ready to Transform Your GST Workflow?

Join thousands of businesses automating their GST reconciliation