Compound Interest - Investment Growth Mastery

Financial Tools

Compound Interest Calculator is your comprehensive solution for mastering the power of compound interest with professional-grade growth analysis tools. I help you transform complex compounding mathematics into clear, actionable insights for investment planning, wealth creation, and financial goal achievement.

We understand how challenging it can be to visualize the true potential of compound interest or compare different investment scenarios manually. Maybe you need to analyze lump sum investments, compare compounding frequencies, or understand long-term wealth creation potential. Compound Interest Calculator eliminates this complexity by providing precise calculations with flexible parameters and professional Excel integration.

Key Benefits

How to Use

Using Compound Interest Calculator is straightforward and powerful:

Basic Compound Interest Calculation

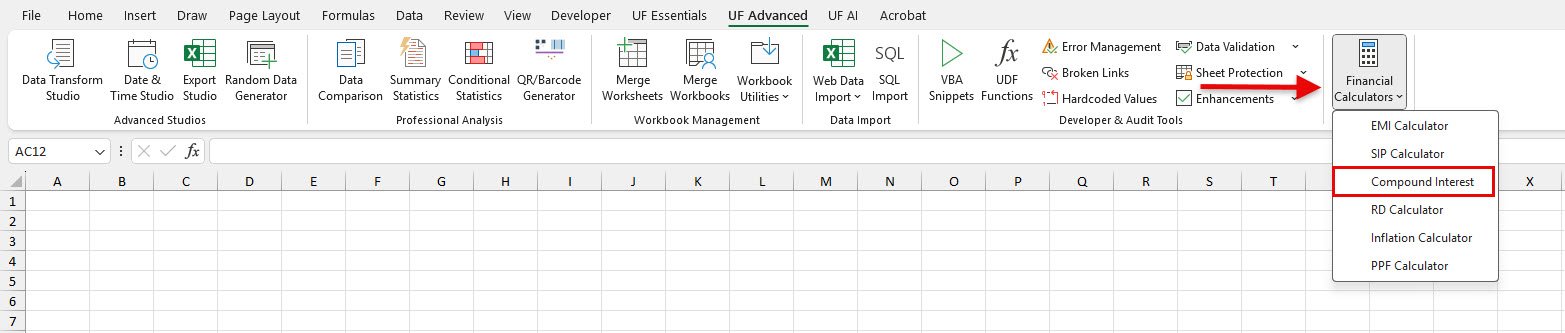

- Go to UF Advanced tab → Financial Tools group

- Click Financial Calculators → Compound Interest

- Enter Investment Details: Principal amount, interest rate, time period, compounding frequency

- View Instant Results: Final amount, interest earned, and growth visualization

- Analyze Impact: See how compounding frequency affects returns

- Add to Excel: Insert complete analysis directly into your worksheet

Advanced Growth Analysis

- Compare Frequencies: Analyze daily, monthly, quarterly, or annual compounding

- Time Value Analysis: Understand the impact of investment duration on returns

- Rate Sensitivity: See how rate changes affect final outcomes

- Professional Integration: Export formatted calculations to Excel for reporting

Examples

Example 1: Fixed Deposit Planning

Scenario: You have ₹5 lakhs to invest in a fixed deposit for 10 years at 7% annual interest.

Steps:

- Open Compound Interest Calculator from UF Advanced → Financial Tools

- Enter Principal Amount: 500000

- Set Interest Rate: 7

- Set Time Period: 10 years

- Compare compounding frequencies:

- Annual: ₹9,83,576

- Quarterly: ₹10,06,266

- Monthly: ₹10,09,463

- Daily: ₹10,10,452

- Choose monthly compounding for optimal returns

Example 2: Long-term Investment Growth

Scenario: You want to see how ₹1 lakh grows over different time periods at 12% annual return.

Steps:

- Launch Compound Interest Calculator

- Enter Principal Amount: 100000

- Set Interest Rate: 12

- Compare time periods with monthly compounding:

- 5 years: ₹1,81,670

- 10 years: ₹3,30,039

- 15 years: ₹5,99,583

- 20 years: ₹10,89,255

- Add to Excel for detailed analysis and visualization

Example 3: Retirement Corpus Building

Scenario: You have ₹10 lakhs today and want to see its growth potential for retirement in 25 years.

Steps:

- Access Compound Interest Calculator

- Enter Principal Amount: 1000000

- Set Interest Rate: 11 (equity mutual fund average)

- Set Time Period: 25 years

- Choose Monthly compounding

- Result: ₹1.37 crores (wealth multiplication of 13.7x)

- Export complete analysis to Excel for retirement planning

Available Analysis Features

Comprehensive Investment Parameters

Advanced input options for precise calculations:

- Principal Amount: Initial investment or deposit amount with flexible value entry

- Interest Rate: Annual interest rate with decimal precision support

- Time Period: Investment duration in years for flexible timeline planning

- Compounding Frequency: Daily, monthly, quarterly, or annual compounding options

Complete Growth Analysis

Professional calculation results and insights:

- Final Amount: Total value after compound interest growth with precise calculations

- Interest Earned: Total interest generated through compounding over time

- Growth Visualization: Clear understanding of wealth multiplication potential

- Real-Time Updates: Instant recalculation as you modify input parameters

Advanced Compounding Options

Sophisticated frequency analysis capabilities:

- Multiple Frequencies: Choose how often interest compounds for optimization

- Frequency Impact: See how compounding frequency affects final returns

- Comparative Analysis: Side-by-side comparison of different compounding scenarios

- Optimization Insights: Understand which frequency maximizes returns

- Investment Strategy: Start early for maximum compounding benefit and choose higher frequency compounding when available

- Rate Selection: Use realistic and achievable interest rates with conservative estimates for safety margin

- Time Management: Allow sufficient time for compounding to work effectively and focus on long-term goals

- Frequency Optimization: Opt for investments with more frequent compounding and ensure all returns are reinvested

- Planning Approach: Factor in inflation impact on real returns and use slightly lower rates for conservative planning

- Consistency: Maintain investment discipline and avoid early withdrawals to maximize compounding benefits

Common Use Cases

Investment Strategy and Planning

- Evaluate lump sum investment opportunities with different compounding scenarios

- Compare different investment products based on rates and compounding frequency

- Plan for retirement corpus building with long-term compound growth analysis

- Analyze the impact of investment duration on wealth creation potential

Financial Goal Achievement

- Calculate corpus growth from current savings for retirement planning

- Plan for future education expenses with compound interest projections

- Build emergency fund growth strategies with systematic compounding

- Understand wealth preservation and real returns after inflation impact

Professional Advisory and Education

- Demonstrate the power of compound interest to clients with clear calculations

- Compare different investment products for client portfolio recommendations

- Create goal-based planning strategies with compound interest analysis

- Provide risk-return analysis with different rate scenarios and time horizons

Frequently Asked Questions

Higher compounding frequency generally increases returns. However, the difference becomes less significant with higher frequencies.

Use conservative estimates: 6-8% for fixed deposits, 8-10% for balanced funds, 10-12% for equity investments. Always consider inflation impact and use slightly lower rates for safety margin.

Starting early is extremely powerful. Due to exponential growth, starting 10 years earlier can result in significantly higher wealth even with the same total investment amount.

Compound interest calculator is ideal for fixed-return investments like FDs, bonds, and PPF. For market-linked investments like mutual funds, use it for projection purposes with realistic return assumptions.

Calculate your real return by subtracting inflation rate from nominal return. For example, if your investment gives 10% and inflation is 6%, your real return is approximately 4%.

While the mathematical principle is similar, use dedicated EMI calculators for loans as they account for regular payments and different calculation methods specific to loan structures.

Related Documentation

EMI Calculator - Loan Planning Made Simple

Calculate EMI, total interest, and amortization schedules for home loans, car lo...

Read DocumentationSIP Calculator - Investment Growth Made Clear

Calculate SIP maturity, wealth gained, and investment growth with comprehensive...

Read DocumentationRD Calculator - Recurring Deposit Planning Simplified

Calculate RD maturity, interest earned, and systematic savings goals. Plan recur...

Read Documentation