Inflation Calculator - Future Value Planning Made Real

Financial Tools

Inflation Calculator is your comprehensive solution for mastering inflation impact analysis with professional-grade purchasing power tools and future value calculations. I help you transform abstract inflation concepts into concrete financial realities for accurate goal planning and investment strategy.

We understand how easy it is to ignore inflation's impact when planning for future financial needs or setting long-term goals. Maybe you're planning retirement expenses, calculating future education costs, or trying to understand real investment returns. Inflation Calculator eliminates this planning gap by providing precise calculations that reveal the true cost of your future financial goals.

Key Benefits

How to Use

Using Inflation Calculator is straightforward and insightful:

Future Value Calculation

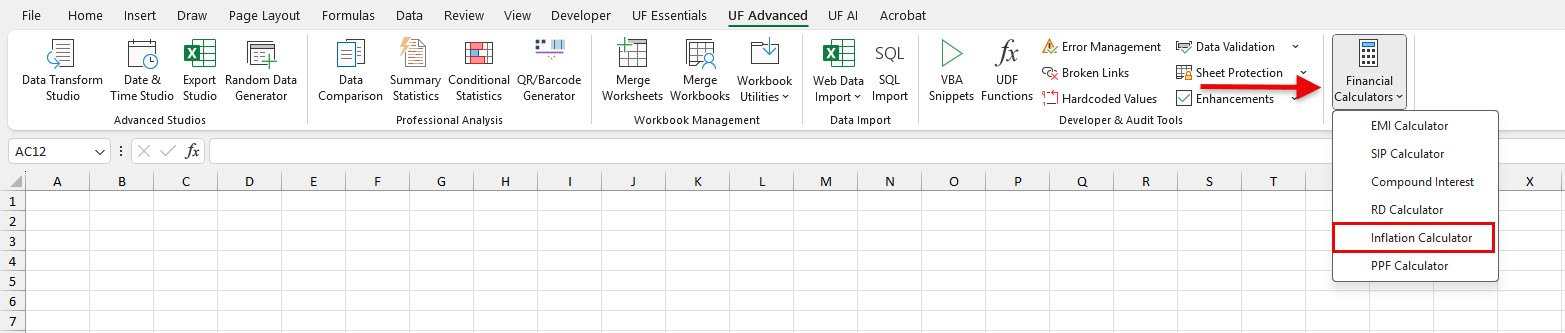

- Go to UF Advanced tab → Financial Tools group

- Click Financial Calculators → Inflation Calculator

- Enter Current Details: Current amount, inflation rate, and time period in years

- View Future Value: What today's amount will cost in the future

- Analyze Impact: Understand purchasing power loss over time

- Add to Excel: Insert complete analysis with detailed breakdown

Present Value Analysis

- Switch to Present Value Mode in the calculator interface

- Enter Future Details: Future amount, inflation rate, and time period

- View Present Value: What future expenses cost in today's money

- Goal Adjustment: Adjust financial goals for inflation impact

- Professional Integration: Export formatted calculations to Excel

Examples

Example 1: Retirement Expense Planning

Scenario: You spend ₹50,000 monthly today and want to know the equivalent expense in 25 years.

Steps:

- Open Inflation Calculator from UF Advanced → Financial Tools

- Enter Current Amount: 50000

- Set Inflation Rate: 6 (average long-term inflation)

- Set Time Period: 25 years

- Result: Future monthly expense ≈ ₹2.15 lakhs

- Insight: You'll need 4.3x more money for the same lifestyle

- Add to Excel for comprehensive retirement planning analysis

Example 2: Child's Education Cost Planning

Scenario: Engineering education costs ₹20 lakhs today. What will it cost when your 5-year-old child reaches college age?

Steps:

- Launch Inflation Calculator

- Enter Current Amount: 2000000

- Set Inflation Rate: 8 (education inflation is typically higher)

- Set Time Period: 13 years (child will go to college in 13 years)

- Result: Future education cost ≈ ₹54 lakhs

- Planning: Need to save considering this inflated cost target

- Rate Selection: Use 6-7% for general inflation, higher rates (8-12%) for education and healthcare categories

- Planning Integration: Always adjust financial goals for inflation and choose investments that historically beat inflation

- Time Perspective: Understand that inflation impact increases exponentially with time and start planning early

- Regular Review: Review and adjust plans based on actual inflation trends and focus on real returns

- Conservative Approach: Use slightly higher inflation rates for safety and maintain flexibility in planning

- Investment Strategy: Prioritize investments that protect purchasing power over long-term periods

Common Use Cases

Retirement and Long-term Planning

- Calculate future living expenses and lifestyle costs for retirement planning

- Adjust retirement corpus for inflation impact and plan for inflation-adjusted income

- Factor in healthcare inflation for medical expense planning

- Calculate inflation-adjusted emergency fund requirements

Education and Goal-Based Planning

- Calculate inflated education costs for children's future schooling and higher education

- Adjust property prices for future house purchase planning

- Plan for maintaining current lifestyle standards in future years

- Prioritize goals based on inflation sensitivity and impact

Frequently Asked Questions

Use 6-7% for general expenses, 8-10% for education costs, 10-12% for healthcare, and 4-5% for food items. Adjust based on current economic conditions and historical trends.

Inflation reduces your real returns. If your investment gives 10% and inflation is 6%, your real return is approximately 4%. Focus on investments that consistently beat inflation.

Yes, using slightly higher inflation rates (1-2% above historical average) provides a safety margin. It's better to over-save than under-save for future goals.

Review inflation assumptions annually or when there are significant economic changes. Update your financial plans based on actual inflation trends vs your assumptions.

Related Documentation

EMI Calculator - Loan Planning Made Simple

Calculate EMI, total interest, and amortization schedules for home loans, car lo...

Read DocumentationSIP Calculator - Investment Growth Made Clear

Calculate SIP maturity, wealth gained, and investment growth with comprehensive...

Read DocumentationCompound Interest - Investment Growth Mastery

Master compound interest calculations with comprehensive growth analysis tools....

Read Documentation