EMI Calculator - Loan Planning Made Simple

Financial Tools

EMI Calculator is your comprehensive solution for mastering loan planning with professional-grade EMI calculations, complete amortization schedules, and detailed financial analysis. I help you transform complex loan mathematics into simple, understandable results for informed financial decision-making.

We know how overwhelming loan planning can be when you're trying to understand EMI amounts, total interest costs, or payment schedules manually. Maybe you're planning a home loan, comparing car financing options, or evaluating personal loan terms. EMI Calculator eliminates this complexity by providing instant calculations with complete breakdowns and professional Excel integration.

Key Benefits

How to Use

Using EMI Calculator is straightforward and comprehensive:

Basic EMI Calculation

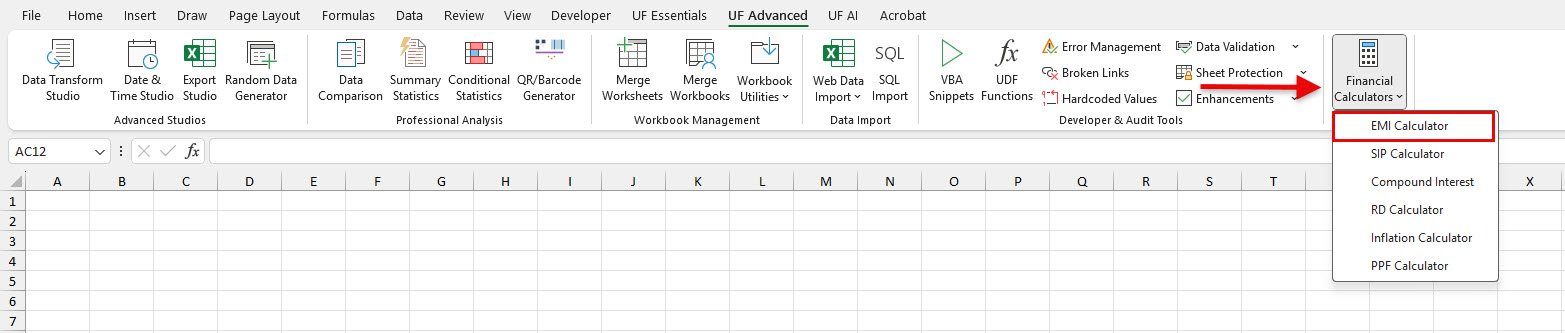

- Go to UF Advanced tab → Financial Tools group

- Click Financial Calculators → EMI Calculator

- Enter Loan Details: Principal amount, interest rate, and tenure in years

- View Instant Results: Monthly EMI, total interest, and total amount payable

- Analyze Impact: See complete breakdown of principal vs interest components

- Add to Excel: Insert complete calculations and amortization schedule

Advanced Loan Analysis

- Complete Amortization: Generate month-by-month payment schedule for entire tenure

- Professional Integration: Export formatted tables with headers and proper styling

- Comparative Analysis: Compare different loan scenarios and terms

- Financial Planning: Integrate loan obligations into comprehensive budget planning

Examples

Example 1: Home Loan Planning

Scenario: You're planning to buy a house worth ₹50 lakhs with a 20% down payment.

Steps:

- Open EMI Calculator from UF Advanced → Financial Tools

- Enter Principal Amount: 4000000 (₹40 lakhs after down payment)

- Set Interest Rate: 8.5 (current home loan rates)

- Set Tenure: 20 years

- Result: Monthly EMI ₹34,492, Total Interest ₹42,78,080

- Add to Excel for complete amortization schedule and budget planning

Example 2: Car Loan Comparison

Scenario: You want to compare different loan tenures for a ₹8 lakh car loan.

Steps:

- Launch EMI Calculator

- Enter Principal Amount: 800000

- Set Interest Rate: 9.5

- Compare different tenures:

- 3 years: EMI ₹25,364, Total Interest ₹1,13,104

- 5 years: EMI ₹16,899, Total Interest ₹2,13,940

- 7 years: EMI ₹13,162, Total Interest ₹3,05,608

- Choose optimal balance between EMI affordability and total interest cost

- Input Accuracy: Use precise interest rates from lenders and include processing fees in principal if applicable

- Financial Planning: Keep EMI under 20% of monthly income and maintain 6-month EMI as emergency reserve

- Comparison Strategy: Compare rates from multiple lenders and consider prepayment options for interest savings

- Analysis Approach: Calculate multiple tenure and rate combinations focusing on total cost, not just EMI amount

- Budget Integration: Ensure EMI fits comfortably in monthly budget and consider future income growth

- Long-term Planning: Consider changing financial needs and maintain flexibility in loan terms

Common Use Cases

Home and Property Financing

- Calculate EMI for home loans with different down payment scenarios

- Compare fixed vs floating rate options for property purchases

- Plan for home improvement loans and renovation financing

- Analyze refinancing options for existing home loans

Vehicle and Asset Financing

- Evaluate car loan options with different tenure and rate combinations

- Compare dealer financing vs bank loans for vehicle purchases

- Plan for commercial vehicle loans and equipment financing

- Analyze lease vs buy decisions with EMI calculations

Frequently Asked Questions

EMI is calculated using the formula P × r × (1+r)^n / ((1+r)^n - 1), where P is principal, r is monthly interest rate, and n is number of months. It includes both principal and interest components.

Fixed rates keep EMI constant throughout the tenure, while floating rates change with market conditions. Use current rates for calculations and consider rate change scenarios.

Generally, keep total EMIs under 40-50% of your monthly income, with individual loan EMIs not exceeding 20-30%. Consider other expenses and maintain emergency funds.

Longer tenure reduces EMI but increases total interest. Choose based on your cash flow needs, but consider prepayment options to reduce total interest cost.

Related Documentation

SIP Calculator - Investment Growth Made Clear

Calculate SIP maturity, wealth gained, and investment growth with comprehensive...

Read DocumentationCompound Interest - Investment Growth Mastery

Master compound interest calculations with comprehensive growth analysis tools....

Read DocumentationRD Calculator - Recurring Deposit Planning Simplified

Calculate RD maturity, interest earned, and systematic savings goals. Plan recur...

Read Documentation